The year 2025 brings a dynamic and uncertain investment environment, marked by economic instability, inflationary pressures, geopolitical tensions, and changes in central bank monetary policies. In such conditions, precious metals – gold, silver, platinum, and palladium – remain a crucial part of investment portfolios for both institutional and individual investors. With ongoing monetary policy adjustments, limited supply, and evolving industrial demand, each of these metals presents unique opportunities and risks in 2025.

Gold: The Key Safe-Haven Asset

Gold has long been considered a fundamental store of value, particularly during periods of financial instability. Over the past decade, its price has steadily increased, reaching a record high of $2,100 per ounce by the end of 2024. Analysts predict that this trend may continue in 2025, influenced primarily by monetary policies of the world’s largest central banks and inflation. Expected changes in interest rates by the Federal Reserve (Fed) and the European Central Bank (ECB) will also play a significant role in market fluctuations, as potential interest rate cuts could boost demand for gold as a safe-haven asset.

Additionally, gold remains a key investment during times of geopolitical risk. The ongoing war in Ukraine, tensions within the European Union, conflicts between China and the West, and political uncertainty in the U.S. will likely drive increased demand for gold as a refuge from market volatility. Central banks, particularly in China, Turkey, and India, continue to expand their gold reserves – having purchased more than 1,100 tons of gold in 2022, the highest amount since 1950. Official data for 2024 is not yet available, but analysts expect that the trend of strong purchases remains unchanged.

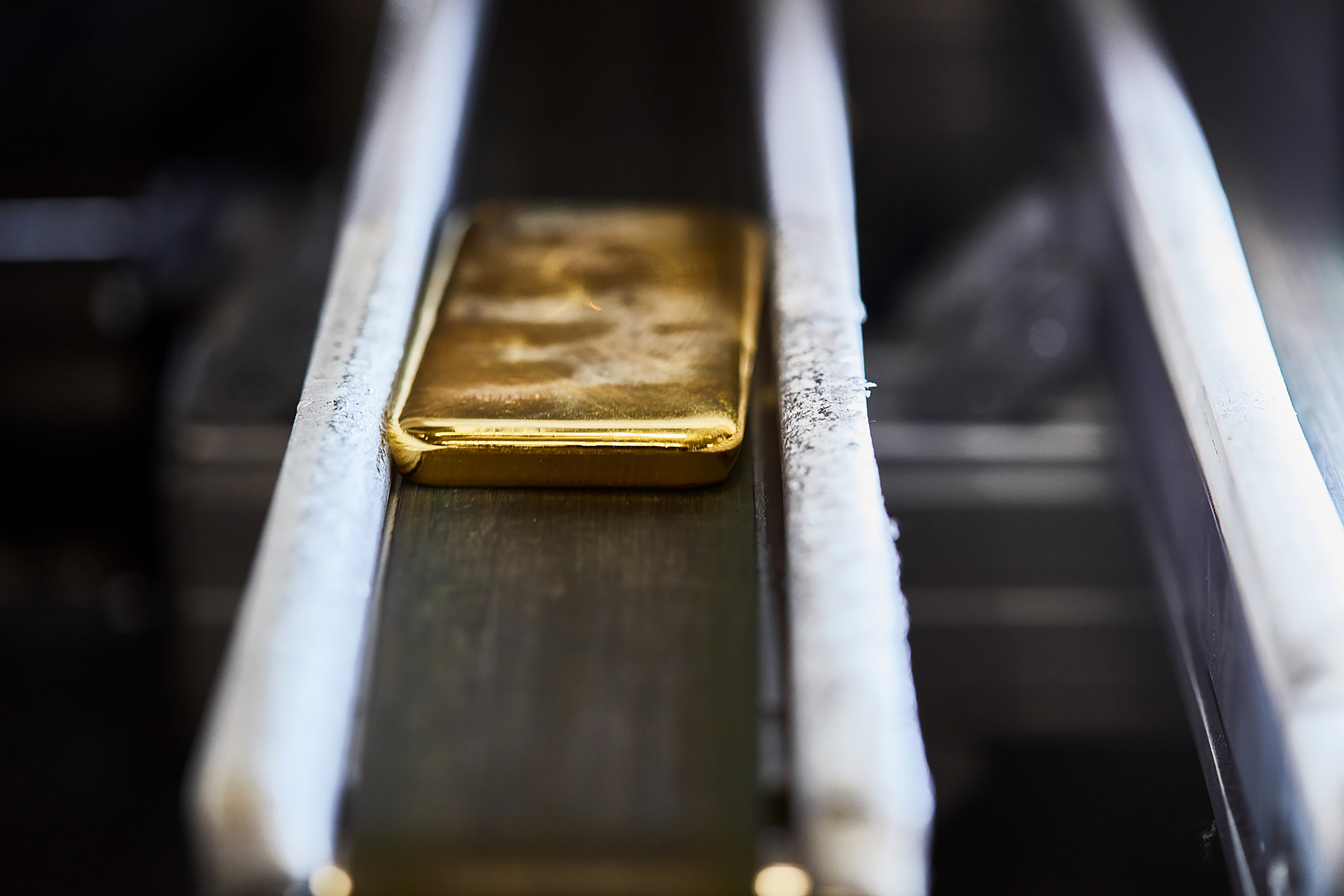

Investors seeking to leverage the benefits of gold have several options available. Physical gold in the form of bars and coins remains the best choice for long-term wealth preservation, as it carries no credit risk. However, it is essential to source gold from reputable and accredited suppliers. Choosing a trusted and certified provider, such as Argor-Heraeus, C. Hafner, or Valcambi (all with Good Delivery certification), is key to ensuring authenticity and liquidity. Additionally, investors should consider storage costs, transaction fees, and potential tax obligations that may impact long-term returns.

For those who prefer alternative investments, gold ETFs offer liquidity, while shares in mining companies provide higher return potential but come with increased risk.

(Jewellery Quarter Bullion, 2025)

Silver: An Undervalued Precious Metal

Silver holds a dual role as both an investment asset and an industrial commodity crucial for the production of solar panels, electronics, and electric vehicles. Over the past year, silver prices have risen to $30 per ounce, with further increases expected, primarily due to higher industrial demand and limited supply.

At the same time, silver is a key material for the green transition, as it is essential for solar panels and electric vehicle batteries. With governments worldwide investing in renewable energy sources, market analysts predict that demand for silver in the photovoltaic sector will continue to rise.

Silver prices are also affected by supply constraints, as mining production struggles to keep up with increasing demand. Analysts warn of potential silver shortages, which could further drive up its price. Another significant factor is the gold-to-silver ratio, which remains historically high and suggests that silver is currently undervalued compared to gold, presenting an opportunity for investors.

(Jewellery Quarter Bullion, 2025)

Platinum: Potential for Growth

Historically, platinum has often been more valuable than gold, but in recent years, it has lagged behind due to weaker industrial demand and substitution with cheaper alternatives.

The automotive industry is the largest consumer of platinum, using it in catalytic converters to reduce emissions. With increasingly strict environmental regulations, particularly in the European Union and China, demand for platinum in the automotive sector is expected to rise again in 2025. Additionally, the development of the hydrogen economy could further boost demand, as platinum is a critical component in hydrogen fuel cells.

Alongside increased industrial demand, supply-side risks are also emerging. South Africa, which produces more than 70% of the world’s platinum, faces challenges such as electricity shortages and labor strikes, which could reduce supply, push prices higher, and offer higher returns for investors.

(Jewellery Quarter Bullion, 2025)

Palladium: A Metal at a Turning Point

Palladium has experienced exceptional price growth over the past decade, reaching a record high of $3,000 per ounce in 2022 due to strong demand in the automotive industry. However, by 2024, prices had begun to decline, as car manufacturers increasingly replaced palladium with cheaper platinum.

Moreover, the shift toward electric vehicles (EVs) is reducing demand for palladium, as EVs do not require catalytic converters, in which palladium is traditionally used. Despite this, geopolitical risks may still impact palladium supply, as Russia – responsible for nearly 40% of global palladium production – remains under Western sanctions.

Investors considering palladium should closely monitor trends in the automotive sector and potential supply disruptions. While palladium’s long-term relevance is diminishing, short-term geopolitical and industrial changes may still create trading opportunities, requiring careful consideration and timely decision-making.

(Jewellery Quarter Bullion, 2025)

The year 2025 presents multiple investment opportunities in the precious metals market. Gold remains the most reliable choice for wealth protection during times of financial uncertainty, while silver stands out with strong industrial potential and long-term growth prospects. Platinum has a promising future, particularly in the automotive and hydrogen technology industries, whereas palladium, due to its volatility, is better suited for short-term speculation rather than long-term investment.