Gold prices could climb to nearly $5,000 per troy ounce (approximately €4,285) if Donald Trump’s attacks on the U.S. central bank, the Federal Reserve, undermine its independence, according to Goldman Sachs.

The Federal Reserve System (commonly known as the Fed) is the central bank of the United States, established in 1913. Its key responsibilities include implementing monetary policy (interest rates, inflation control), regulating the banking system, and maintaining financial stability. The Fed operates as an independent institution, meaning its decisions are made separately from the short-term political interests of any administration – a principle that has often been subject to debate, criticism, and political pressure.

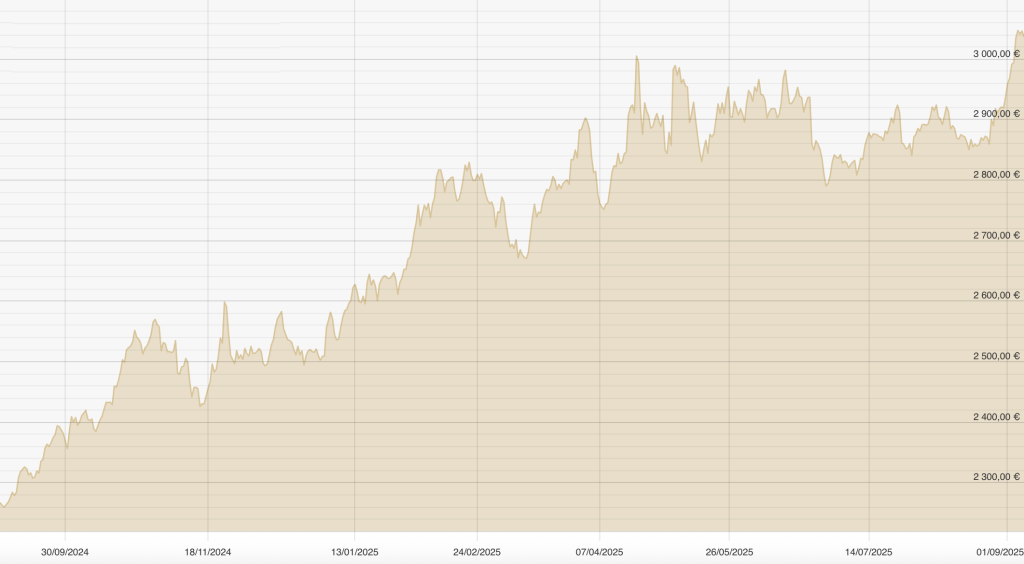

This year, gold has gained more than 34 percent, surpassing the $3,500 per ounce mark (around €3,000), making it one of the best-performing asset classes. Demand has come from both investors and central banks, which are expanding their holdings to hedge against political instability and concerns over debt sustainability. Traditional safe havens, such as the U.S. dollar and government bonds, have come under pressure in this environment.

A key driver behind recent capital flows is growing concern that the U.S. administration could exploit a weakened Fed for political purposes. Investors fear that, in such a scenario, the central bank would be quicker to cut interest rates, pushing long-term inflation expectations higher and eroding the value of U.S. Treasuries. Trump’s attempt to dismiss Fed governor Lisa Cook, which is currently being contested in court, marks the latest escalation of his conflict with the central bank.

According to Goldman Sachs – one of the world’s largest investment banks and a leading institution in investment banking, trading, and asset management – a loss of Fed independence would likely result in higher inflation, lower stock and long-term bond prices, and a gradual erosion of the U.S. dollar’s status as the world’s reserve currency. Gold, however, would remain a store of value that does not rely on institutional trust.

Goldman Sachs’ base case scenario foresees gold reaching $4,000 per ounce (about €3,430) by mid-2026. Daan Struyven, co-head of global commodities research at Goldman Sachs, emphasized that a larger shift of capital out of U.S. Treasuries into gold could push prices significantly higher. If just one percent of the privately owned U.S. Treasury market were to move into gold, prices could approach $5,000 (approximately €4,285) per ounce.

Stronger demand has also come from central banks, which have increased their gold purchases fivefold since Russia’s invasion of Ukraine in 2022. Private investors, too, have been adding gold to their portfolios as a hedge against inflation. Analysts note that long-term U.S. Treasuries are finding it increasingly difficult to serve as a safe haven during equity downturns, whereas gold has proven to be a reliable diversifier and a cornerstone of more resilient portfolios.

Considering an investment in gold? Explore our offer and request a free consultation – contact us by phone at 080 24 28, write to us, or visit one of Gold Store’s branches across Slovenia.