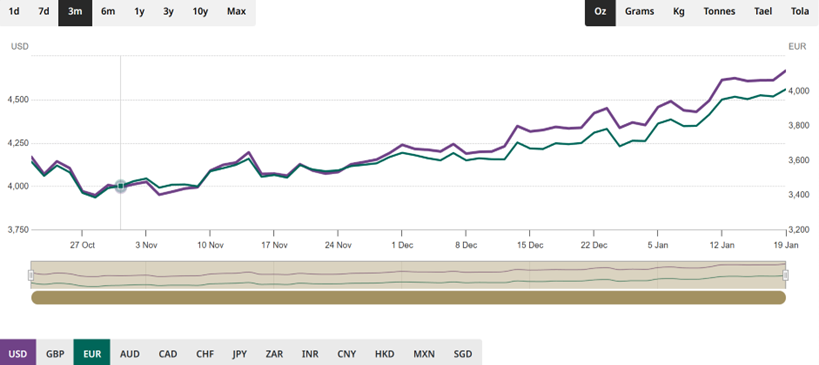

Early 2026 was marked by heightened volatility in the gold markets: Following rapid rises to record-breaking highs, there was a temporary correction before further growth. The key message for investors is clear: When the market price stabilises quickly after a fall and continues to reach new highs, this signifies high and widespread demand – from retail to institutional investors and central banks.

What is happening in the precious metals markets in January 2026

According to Reuters, Gold reached consecutive new highs in January: hitting its first record of the year on 12 January, surpassing it on 14 January, before a short correction on 16 January, when some investors realised their profits after the steep price growth. In the following days, the market bounced back, reaching a new record high on 20 January.

The price mostly remained around 4000 EUR per ounce, rising to 4050 EUR at the peaks, and falling to 3900 EUR during the correction. This type of price behaviour signals that gold remains at high levels despite temporary corrections.

Why Gold rose in value: Interest rates, investor uncertainty, and a move to safer investments.

Because gold is not an interest-generating asset, it tends to perform well when the market is anticipating a reduction in interest rates. During the January market changes, Reuters repeatedly pointed out that the rising prices were supported by expectations of interest rate cuts, fluctuations in the value of the US dollar and increased uncertainty, which causes investors to turn to investments traditionally thought to be safer.

Practical implications: When investors sense a rise in political and financial instability, they usually become more likely to invest part of their capital in gold. The 16 January correction was expected, given that steep rises in market prices induce some investors to realise their profits. More crucially, gold was quick to reconsolidate, confirming the steadiness in demand.

Why do prices remain high?

One of the principal reasons for the continuing high gold price despite short-term corrections is the composition of its demand. The market is made up of three concurrent classes of buyers: retail investors, institutional investors, and central banks. Retail investors usually buy gold as a method of long-term savings (inflation-proof and increases financial security in uncertain periods), while institutional investors mostly rely on it for diversification and hedging risk in investment portfolios, often via publicly traded funds backed by gold. As per the World Gold Council, these funds recorded the highest-ever profits in 2025 (roughly 89 bn USD), including previously unparalleled amounts of capital under management and gold held by funds.

Central banks play a unique role, buying gold as part of their management of foreign exchange reserves. Their principal motives are reserves diversification, long-term value retention, protecting against inflation, and reducing geopolitical risks. These goals are outlined both in research by the World Global Council and a European Central Bank analysis, which reiterates diversification as the principal consideration, with protection against geopolitical risks as another important driver.

Speaking on the record-breaking start of 2026, Reuters pointed out that there is talk again at the bigger stock markets about the possibility of approaching 5000 USD per ounce in 2026, should the risk aversion and interest rate expectations continue.

Supply cannot increase rapidly, as it is underpinned by local circumstances

Gold supply cannot be significantly increased over a short period of time. The mining industry is cost- and time-consuming, and thus cannot quickly accommodate an increase in demand. Moreover, the scope of gold extraction is influenced by local circumstances. Reuters reported that 2025 saw the Mali gold manufacturing industry fall by roughly 22,9 percent, chiefly because of a regulatory row within the sector. While such events do not necessarily influence the global price of gold by themselves, they serve as a reminder that increased uncertainty can rapidly drive down supply, additionally perking up the price when demand is high.

Why gold remains an important long-term investment

When gold prices are high, many potential investors are rightly concerned about having missed the buying window. However, investing in gold necessitates a different approach. As a general rule, Gold should not be acquired to chase short-term price peaks or lows, but rather for long-term consolidation of buying power and as an important tool of asset diversification.

As such, most investors benefit more from a gradual entry into the market with sequential buys. Such a trading strategy minimises the risk of a lump investment right before a price correction, while also facilitating a systematic and disciplined creation of a gold reserve. In short, long-term stability instead of short-term speculation.

It is also worthwhile considering the bigger picture. According to Reuters, some analysts contemplate the possibility of gold reaching 5000 USD per ounce in 2026. Such forecasts are not guaranteed and should not influence an impulse buy, but serve as a market signal that gold remains a major protective and strategic investment in uncertain times, inflationary pressures, and geopolitical risks.

The key takeaway remains clear: gold is a long-term investment. It should be bought as part of a strategy with reference to years instead of days. The best time to buy is often when you have a comfortable financial reserve, a clear intent, and the discipline for investing over multiple years. Short-term fluctuations are an integral part of the markets, but the real value of a long-term approach is its basis in a thoughtful and gradual approach to wealth protection over time, instead of guessing peaks and lows.

Thinking about investing in gold or silver? You are kindly invited to consider our offers and use our free advising services! Send us an email, call 080 24 28, or visit us at your nearest Gold Store branch – our kind advisors will be happy to help you.