Gold is once again stepping into the spotlight as one of the key safe-haven investments amid rising global uncertainty – a trend emphasized by Citigroup, one of the largest American investment banks. Just recently, Citi Research, the bank’s analytical division, released an updated three-month gold price forecast, raising its target to USD 3,500 per troy ounce (approximately EUR 3,220). The projected trading range during this period lies between USD 3,300 and 3,600 (approx. EUR 3,035–3,315), suggesting the precious metals market is entering a new phase of optimism, particularly among institutional investors.

Headquartered in New York, Citigroup is one of the world’s largest financial institutions, operating in over 160 countries. It offers a wide range of services across investment banking, wealth management, capital markets, and financial research. Citi Research is considered one of the most influential analytical divisions on Wall Street, and its forecasts frequently impact global market trends.

The upward revision of gold price forecasts is driven by several converging factors that, according to analysts, are significantly increasing demand for gold as a safe-haven asset. The primary catalyst behind the current rally is the increasingly uncertain macroeconomic outlook in the United States. Recent data from the U.S. labor market – which shifted expectations regarding monetary policy – revealed signs of a slowdown: only 73,000 new jobs were created in July 2025, well below expectations. Analysts now estimate with more than 80% probability that the U.S. Federal Reserve (Fed) will begin lowering interest rates as early as September, a move that could boost gold prices further.

In addition to domestic U.S. factors, analysts point to ongoing geopolitical tensions worldwide as a further driver of increased gold demand. Rising trade friction – particularly due to the U.S. imposing higher tariffs – the continued war in Ukraine, political instability in parts of Asia, and a general weakening of investor confidence in equities have created an environment in which investors are once again turning to gold as a stable and liquid investment. A further contributing factor is the weaker U.S. dollar, which lowers the cost of gold for investors outside the U.S., thereby further stimulating global demand.

Citi Research also highlights strong growth in gross gold demand, which has increased by more than 35% since mid-2022. This surge is not only the result of increased interest among individual investors, but also of growing activity among central banks, which have been increasing their gold reserves in response to uncertainty in the global monetary system. This type of demand is considered structural and long-term, as central banks use gold to reinforce the stability of their balance sheets and reduce reliance on individual currencies – particularly the U.S. dollar.

Despite the overall optimism, analysts urge a balanced perspective when looking at future gold price movements. More conservative forecasts suggest that gold could trade in the range of USD 3,100 to 3,500 (approx. EUR 2,850–3,220) in the last quarter of 2025, and could stabilize around USD 2,800 (approx. EUR 2,575) in the first half of 2026 – assuming an improvement in U.S. economic outlook, declining inflation, and a stronger dollar. However, analysts generally do not assign a high probability to this more moderate scenario.

What does this mean for investors? Gold continues to be viewed as an important long-term wealth preservation tool, especially during periods of volatility. Current holders of physical gold are in a favorable position, as their investments are retaining high value. For those considering entering the precious metals market, experts recommend a gradual and well-considered investment strategy with proper risk diversification, given the potential for market conditions to shift rapidly in the coming months.

Gold has long held its reputation as a store of value, independent of central bank policy and equity market fluctuations. In light of increasing global unpredictability and the growing likelihood of interest rate cuts in the U.S., its role in investor portfolios is expected to remain vital. Forecasts exceeding USD 3,500 per ounce reflect continued confidence in gold as a strategic asset and serve as a clear signal that markets are once again seeking security.

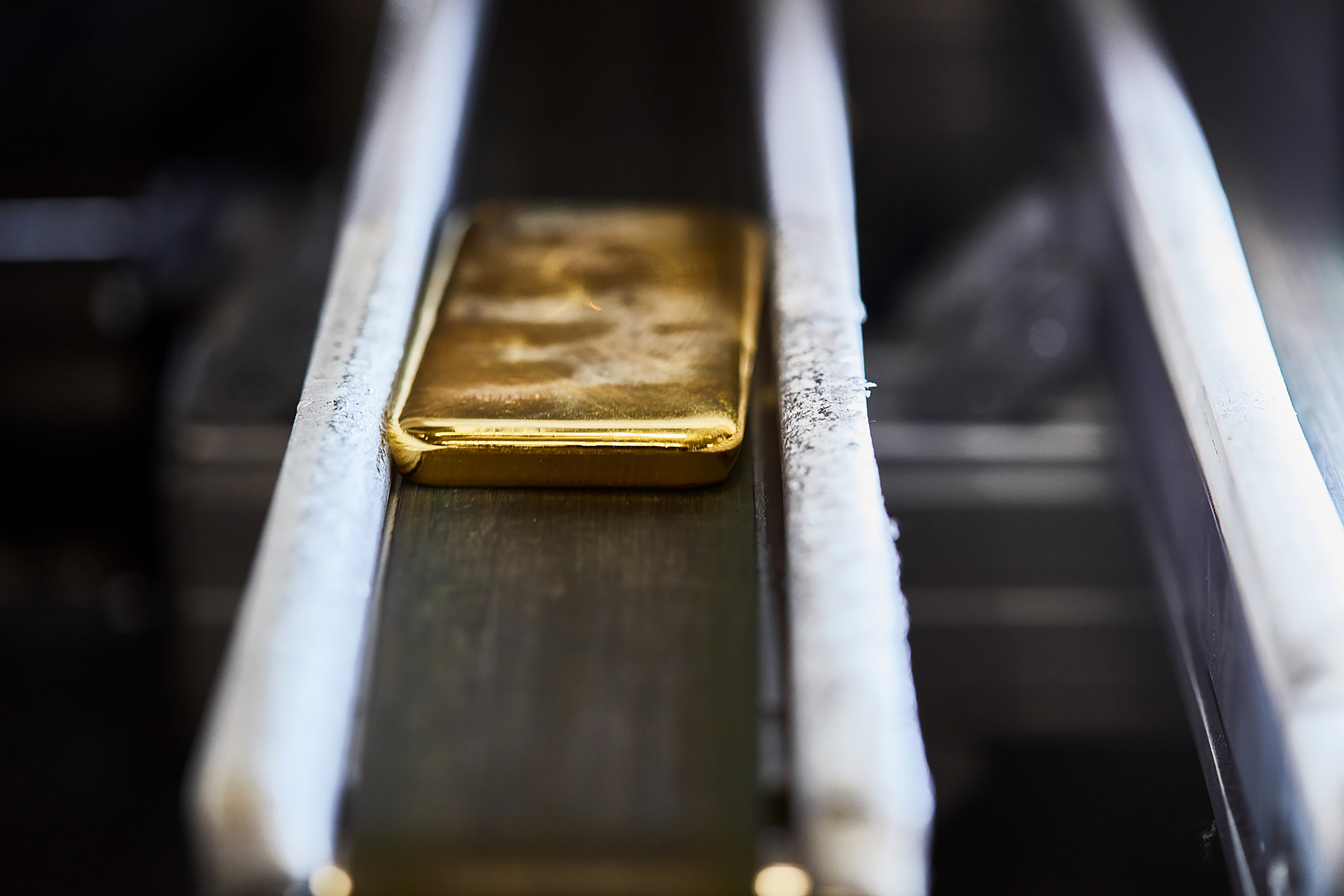

Considering investing in gold? Choose safety and reliability – at Gold Store, we offer a wide selection of investment bars from the renowned Swiss refinery Argor-Heraeus. For more information and free consultation, call 080 24 28 – our advisors will be happy to assist you.