After weeks of uncertainty and heightened tension on the precious metals markets, the U.S. administration has officially confirmed that gold will not be subject to the planned import tariffs. The announcement, made by President Donald Trump on August 11, 2025, on his Truth Social profile, followed media reports suggesting that gold bars of one kilogram and 100 ounces could fall under the scope of new tariff measures. These reports had triggered strong reactions among investors and temporarily disrupted supply chains.

On July 31, 2025, the U.S. Customs and Border Protection (CBP) issued a ruling indicating that 1-kilogram and 100-ounce gold bars would fall under a 39% import tariff. The announcement immediately raised concerns over potential disruptions in the global gold trade. However, on August 11, 2025, President Trump clarified in a statement on the Truth Social platform that “gold will not be subject to tariffs,” a move that swiftly reassured markets and restored stability to the precious metals sector.

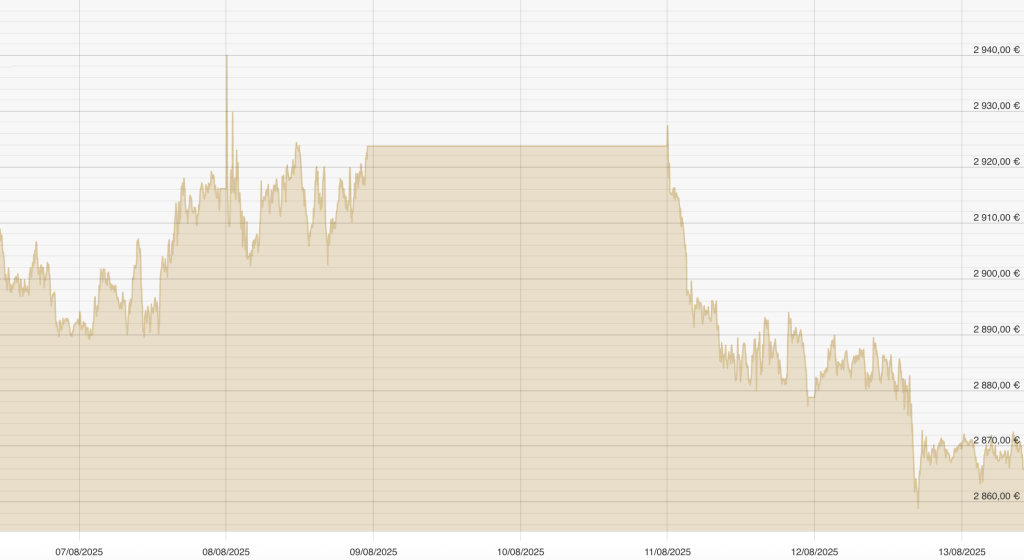

Amid a surge of media reports on the potential imposition of a 39% tariff, gold futures spiked to around $3,500 per ounce (approximately €2,980). Liquidity conditions tightened, with some dealers halting shipments of investment gold to the United States pending further clarification. Refiners cautioned about possible delays in deliveries, while institutional investors stepped up purchases of physical gold as a safeguard against regulatory uncertainty and escalating geopolitical risks.

Uncertainty eased significantly only after U.S. President Donald Trump publicly stated that gold would not be subject to the proposed tariffs. Markets responded with a marked correction, as spot prices fell by roughly 2 to 2.5 percent, spreads between spot and futures prices narrowed, and liquidity conditions normalized. Nevertheless, the episode underscored the market’s inherent vulnerability to political and administrative interventions and highlighted the need for continuous monitoring of the regulatory landscape.

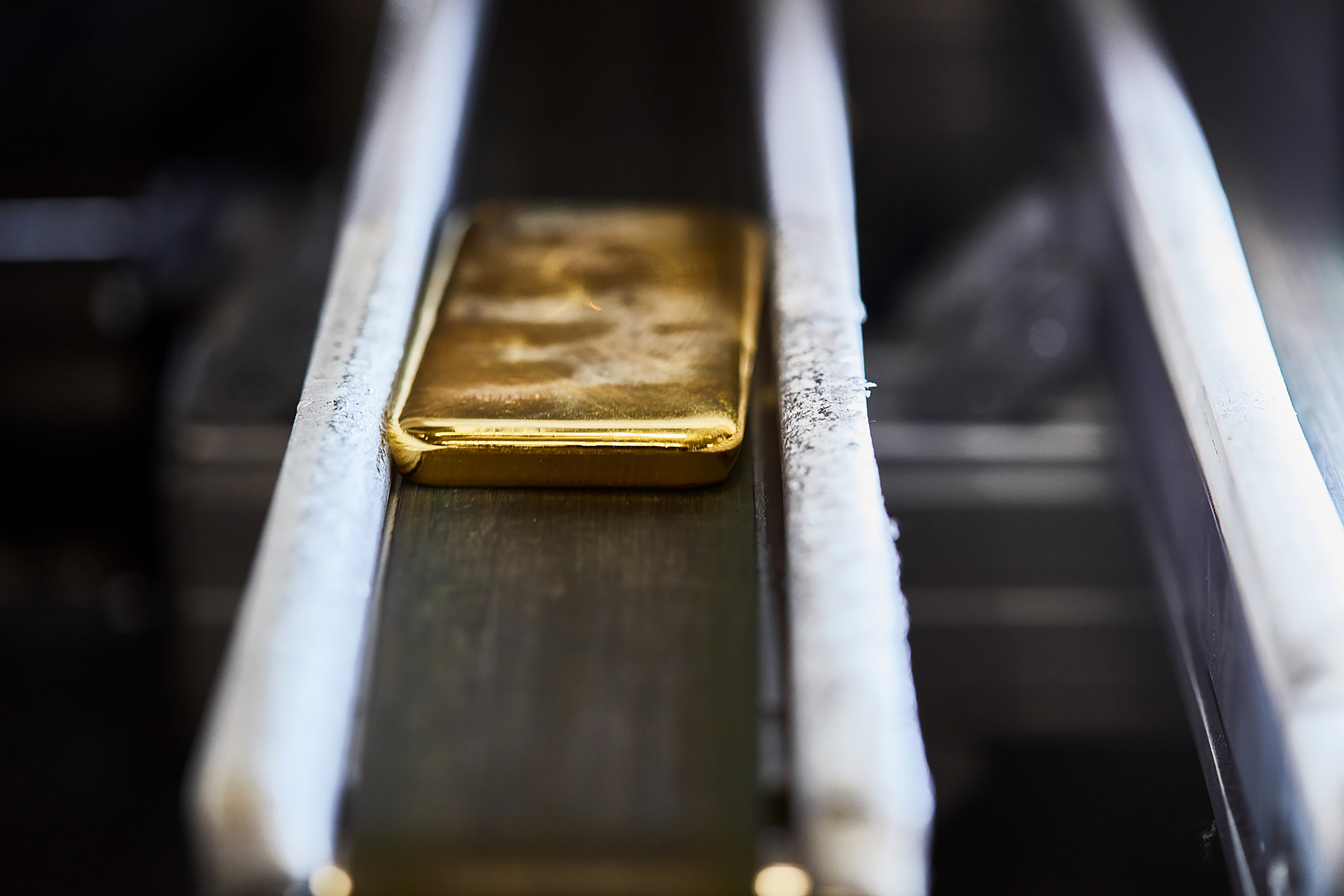

From an investment strategy perspective, the episode provides several important lessons. First, the valuation of gold is shaped not only by supply-demand dynamics or macroeconomic indicators but also, to a significant extent, by perceptions of political risk. Second, physical gold – in the form of investment bars and coins – remains an asset free from counterparty risk, giving it a relative advantage over derivative instruments such as ETFs, futures contracts, or mining equities. The events of 2008 already demonstrated that during periods of financial stress, the value of gold-linked financial products can decline sharply or their liquidity may freeze altogether, while the value of the physical metal tends to hold steady or even appreciate.

Third, portfolio diversification is critical not only in terms of allocating across different asset classes but also in the selection of investment vehicles within a single category. A combination of physical gold stored in secure vaults and liquid financial instruments can provide an optimal balance between return, accessibility, and security.

Although this episode of uncertainty was resolved relatively quickly and without structural consequences for the market, it once again demonstrated how swiftly incomplete or misinterpreted information can trigger volatility, disrupt supply chains, and drive price movements that go well beyond short-term technical corrections. For long-term investors in precious metals, this underscores the need to incorporate political and regulatory signals into their analyses – alongside traditional indicators such as real interest rates, inflation expectations, and currency dynamics—as these factors can significantly reshape the investment landscape.

Gold thus remains not only a hedge against inflation but also a strategic instrument for preserving value during periods of regulatory and political uncertainty. The events of August 2025 once again confirmed that the ability to quickly and accurately interpret such signals is among the key competitive advantages of the modern investor.

Thinking about investing in gold but need more information? Call us at our toll-free number 080 24 28 – our advisors will be happy to assist you!