After a summer marked by uncertainty triggered by discussions over potential U.S. tariffs on gold, investors are once again turning their attention to the long-term trends shaping the precious metals market. An analysis by MKS PAMP, one of the world’s leading refineries and traders of precious metals, emphasizes that gold remains a key safe-haven asset with further growth potential in the coming months—reaching as high as $3,600 (≈ €3,290) per ounce in the most optimistic scenario. However, according to Nicky Shiels, Head of Metals Strategy at MKS PAMP, relative outperformance in the latter part of 2025 is more likely to come from silver and platinum, both of which offer greater upside due to their industrial and market dynamics.

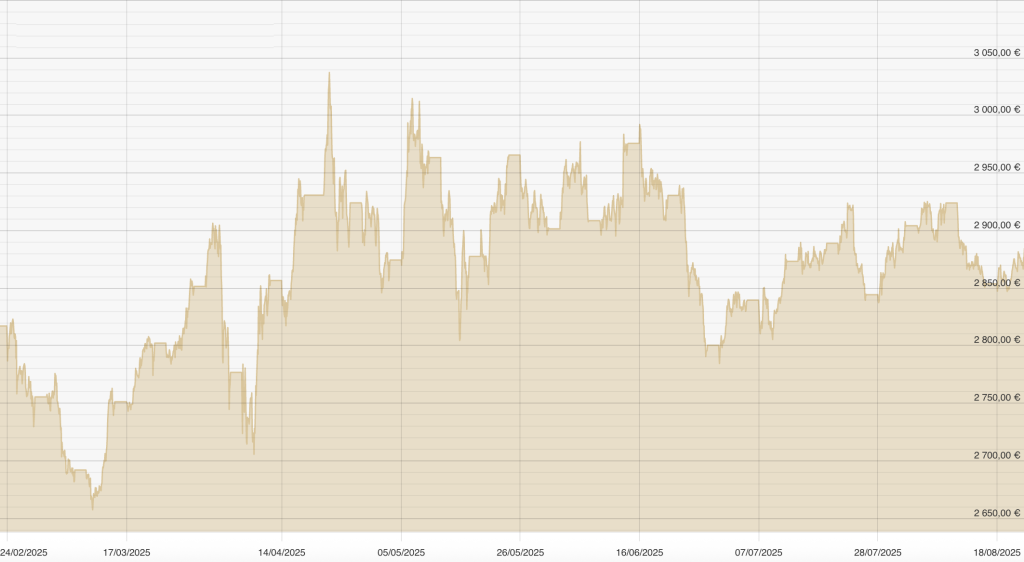

Gold: Balancing Security with Limited Upside

In the base case, which MKS PAMP sees as the most likely outcome, the average price of gold is expected to hover around $2,750 (≈ €2,510) per ounce. Short-term corrections toward $2,500 (≈ €2,280) remain possible, while temporary rallies could push prices to $3,200 (≈ €2,930). If inflationary pressures persist, the dollar weakens, and geopolitical risks intensify, gold could even climb to $3,500 (≈ €3,200). Conversely, tighter monetary policy or a deeper global recession could drag the price down to $2,200 (≈ €2,000). This wide range underlines that gold in the coming months will continue to serve primarily as a store of value and safe-haven asset, rather than as a leading source of returns.

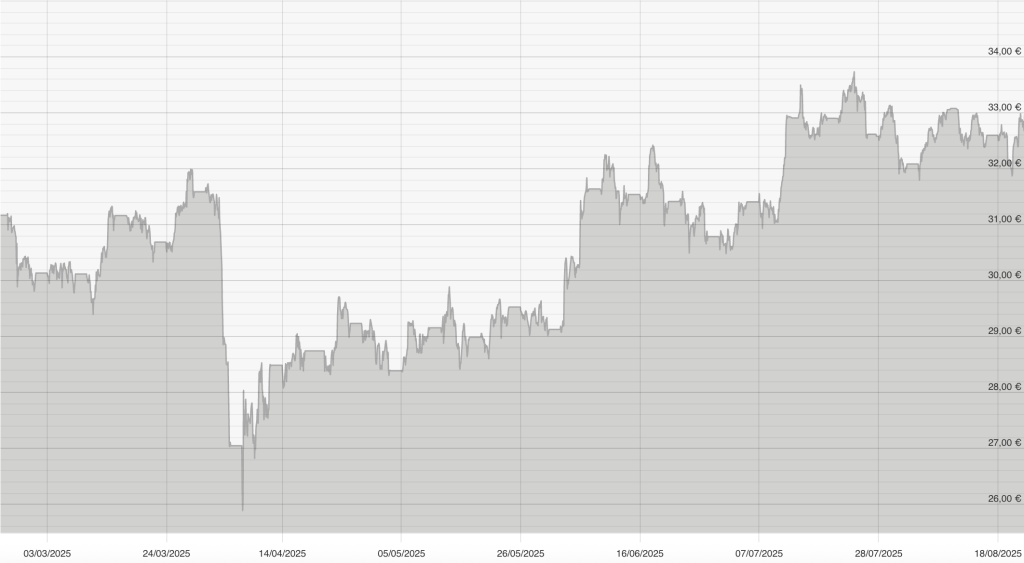

Silver: Growth Driven by Industrial Demand

In 2025, silver continues to strengthen its position as a metal whose price dynamics extend beyond investment demand and rely heavily on industrial applications. Its critical role in solar panel production and the broader renewable energy sector creates a structural support for prices. In the base scenario, MKS PAMP projects silver to average around $36.5 (≈ €33) per ounce. If global investments in green technologies accelerate, prices could climb to $45 (≈ €41), marking a significant milestone in the final quarter of the year. On the downside, should industrial growth slow, silver could correct to $22 (≈ €20), although this scenario appears less probable given current indicators.

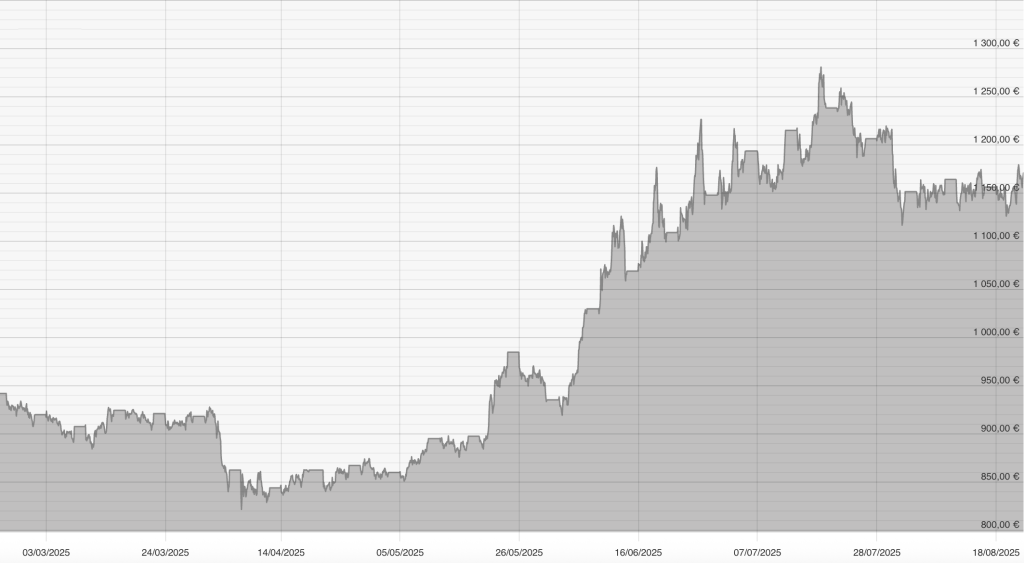

Platinum: Opportunity in the Automotive Sector

Often overshadowed by gold, platinum is regaining significance in the second half of 2025. Its outlook is strongly tied to the automotive industry, where tighter environmental regulations are increasing demand for platinum in catalytic converters, while interest in platinum as a substitute for palladium is also rising. Forecasts place prices between $900 and $1,200 (≈ €825–1,100), with potential to reach $1,400 (≈ €1,280) under favorable conditions. However, a slowdown in global manufacturing or weaker industrial demand could push prices down toward $700 (≈ €640). Despite these risks, platinum remains the precious metal with the most room for positive surprises in late 2025.

Key Drivers Shaping the Market

Several macroeconomic and political factors will influence the dynamics of precious metals in the final quarter of 2025. Persistent inflation continues to boost the appeal of gold and silver as hedges against currency debasement. The U.S. dollar, which has remained strong in recent months, acts as a short-term headwind, though long-term de-dollarization trends and central bank diversification of reserves could generate additional demand. China’s role is equally decisive: fiscal stimulus measures and efforts to stabilize its property market are supporting industrial demand for both silver and platinum. Meanwhile, geopolitical tensions – from Eastern Europe to trade disputes in Asia—are reinforcing investor interest in safe-haven assets.

Strategic Considerations for Investors

MKS PAMP’s analysis highlights three central insights for investors developing their strategies:

Final Outlook

As precious metals enter the final quarter of 2025, gold continues to serve as a cornerstone safe-haven asset. Yet, it is becoming increasingly evident that silver and platinum will drive outperformance. Industrial demand for silver and structural shifts in the automotive industry that favor platinum are laying the foundation for new milestones, while gold remains a reliable but less dynamic option. For investors, this underscores the need to monitor not only traditional indicators – such as interest rates and inflation – but also the political and regulatory signals that increasingly shape market movements.

Are you considering investing in gold, silver, or platinum but need more information? Call us at the toll-free number 080 24 28 – our professional advisors will be happy to assist you!