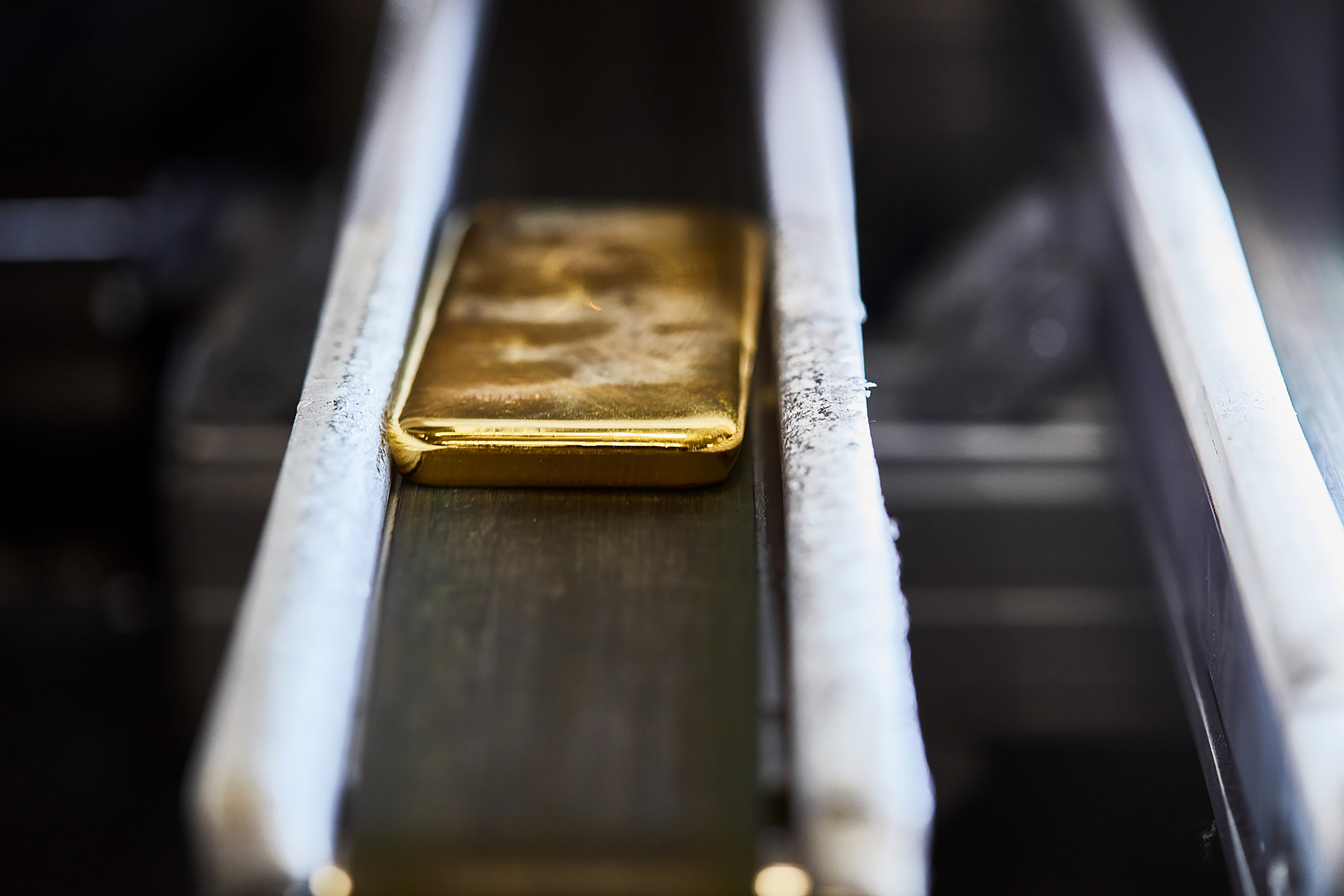

Gold continues to affirm its role as one of the strongest safe-haven assets during times of market turbulence. Over the past week, its market price has risen by more than 11 percent to €3,204.09 per ounce, just shy of the all-time high of €3,208.02 per ounce. This rally is driven by mounting geopolitical uncertainty, expectations of U.S. interest-rate cuts, and growing demand from both private and institutional investors seeking security – factors that together sustain the precious metal’s appeal and keep prices close to record levels.

Despite cautious guidance from the U.S. Federal Reserve, investors continue to anticipate lower interest rates. Such expectations enhance the attractiveness of gold, which pays no interest and therefore becomes more competitive in a low-borrowing-cost environment. At the same time, escalating global tensions – ranging from security issues to economic risks – prompt investors to shift assets into traditional safe havens. Historically, gold has been one of the most sought-after stores of value in such conditions. Even amid the overall upward trend, some investors have taken advantage of high price levels to realise profits, creating short-term selling pressure that so far has not threatened the longer-term bullish momentum.

Which opportunities and strategies are currently opening up for investors? Gold has traditionally been an essential component of portfolio diversification, particularly in times of elevated global uncertainty. When considering a purchase, it is advisable to take into account the broader context – from currency movements and tax treatment to logistics and the choice of reliable suppliers. In shaping an investment strategy, investors may wish to focus on the following:

Entering during potential corrections – Market fluctuations can open new entry points, especially if forecasts for lower interest rates materialise..

Cost optimization – Effective cost management for both acquisition and secure storage is crucial. At Gold Store, we therefore offer up to 24 months of free storage with every investment- gold purchase, contributing to long-term cost efficiency.

If we conclude, gold remains one of the most reliable ways to preserve wealth. With expectations of interest-rate cuts and continuing global uncertainty, demand stays strong and prices hover just below historic highs. Although occasional profit-taking can trigger short-term pullbacks, the long-term fundamentals for growth remain solid. A thoughtful, cost-efficient and well-timed approach is therefore key for investors seeking to capture gold’s potential in the months ahead.

Considering an investment in gold? Explore our offer and request a free consultation – contact us by phone at 080 24 28, write to us, or visit one of Gold Store’s branches across Slovenia.